1. DSP Global Innovation Fund of Fund Kya Hai?

2. Fund of Fund (FoF) Structure?

Fund of Fund yaani FoF ek aisa mutual fund hota hai jo directly stocks ya bonds me invest nahi karta, balki dusre mutual funds me invest karta hai. Ye ek layered structure hota hai – jahan aap ek Indian mutual fund me invest karte hain, aur woh fund kisi aur (jaise global) mutual fund me paisa lagata hai.

FoF Ka Kaam Karne Ka Tarika:

Example se samjhte hain:

- Aap invest karte ho DSP Global Innovation Fund of Fund me (₹1000 SIP)

- Ye fund aapka paisa invest karta hai DSP World Innovation Fund (Franklin Templeton Luxembourg) me

- Wahan se paisa invest hota hai Tesla, Nvidia, Apple jaise companies me

Yani aap indirectly global tech giants ke shareholder ban jate hain – bina foreign demat ya USD me paisa bheje.

Fund of Fund ke Key Features:

- Diversification: Ek FoF multiple underlying funds me invest karta hai – jisse risk control hota hai

- Convenience: Aapko alag se foreign mutual funds ya ETFs dhoondhne ki zarurat nahi

- INR me Investment: Aap normal Indian mutual fund ki tarah SIP/Lumpsum kar sakte hain

- Professional Management: Underlying fund ko manage karte hain global experts

FoF ke Kuch Limitations Bhi Hote Hain:

- Double Expense Ratio: FoF aur underlying fund dono ka expense charge hota hai

- Taxation: Agar FoF equity-oriented nahi hai (jaise ye wala fund), toh aapko debt fund ki tarah tax dena padta hai

Bottom Line: Fund of Fund structure un investors ke liye best hai jo international diversification chahte hain bina complicated process ke. Lekin expense aur tax structure ko samajhna zaroori hai.

3. DSP Global Innovation Fund of Fund Portfolio Details (2025)

DSP Global Innovation Fund of Fund ka primary exposure DSP World Innovation Fund ke through hai, jiska portfolio duniya ke top innovative companies par based hai.

Niche latest portfolio details diye gaye hain (as of June 2025).

🔹 Top 10 Holdings:

| Company | Sector | Country | Portfolio Weight (%) |

|---|---|---|---|

| NVIDIA Corp | AI / Semiconductors | USA | 9.8% |

| ASML Holdings | Tech Hardware | Netherlands | 7.4% |

| Apple Inc. | Consumer Tech | USA | 6.9% |

| Amazon | Cloud / E-commerce | USA | 6.2% |

| Tesla Inc. | EV / Innovation | USA | 5.8% |

| Illumina Inc. | Biotech / DNA | USA | 5.1% |

| Alphabet (Google) | AI / Tech | USA | 4.6% |

| Cloudflare | Cybersecurity | USA | 3.9% |

| Samsung Electronics | Electronics | South Korea | 3.5% |

| Alibaba | Tech / Retail | China | 2.9% |

📊 Sector Allocation:

- Technology & AI – 41%

- Biotech / Pharma – 19%

- EV / Green Energy – 11%

- Cybersecurity – 8%

- Cloud & Internet Infra – 15%

- Others – 6%

🌍 Country-Wise Allocation:

- USA – 68%

- Europe – 15%

- Asia (China, Korea) – 12%

- Others – 5%

Note: Portfolio allocation subject to change. Latest NAV and factsheet DSP website ya app par check kar sakte hain.

4. Is Fund ke Fayde (Benefits)

- International Diversification: Aapke portfolio me USA, Europe, Asia ke top innovation stocks aate hain.

- Future-centric Themes: AI, Cloud, Biotech jaise sectors jo agle 10 saal me grow karne wale hain.

- Professional Fund Management: Global experts manage karte hain underlying fund ko.

- INR me invest: Aapko USD account ya LRS (Liberalized Remittance Scheme) ki zarurat nahi padti.

5. Risk Factors Jo Dhyan Me Rakhna Chahiye

- High Volatility: Innovation companies me tezi se price movement hoti hai.

- Currency Risk: Dollar-INR ke movement ka impact padta hai returns pe.

- High Expense Ratio: FoF structure ke wajah se double cost lagti hai.

- Long-Term Horizon Zaroori Hai: Minimum 5–7 saal ka view hona chahiye.

DSP Global Innovation Fund: Kya Ye Aapke Liye Sahi Investment Hai?

Har fund har investor ke liye nahi hota. Isliye yeh samajhna zaroori hai ki aapke investment goals, risk tolerance aur time horizon ke hisab se ye fund kitna suitable hai.

Ye fund un logon ke liye sahi ho sakta hai jo:

- Apne portfolio me thoda global exposure aur diversification chahte hain

- Artificial Intelligence, Robotics, Biotech jaise sectors me long-term potential dekhte hain

- High-risk, high-return investment se comfortable hain

- Kam se kam 5–7 saal ka investment horizon rakhte hain

- Already Indian mutual funds me invest kar chuke hain aur portfolio ko balance karna chahte hain

Short-Term ya Conservative Investors ke liye ye fund suitable nahi hai.

7. SIP vs Lump Sum – Kaun Sa Better Hai?

Global innovation sector me high volatility hoti hai, isliye SIP zyada suitable hota hai.

SIP se aap market ke high-low ka average nikalte ho (Rupee Cost Averaging). Lump sum tabhi jab market me correction ho.

8. Kaise Invest Karein DSP Global Innovation Fund of Fund Me?

Aap following platforms ke through invest kar sakte hain:

- INDmoney (Simple global fund SIP setup)

- Groww / Zerodha Coin / Kuvera

- DSP ki official website

Minimum SIP amount: ₹500 se start kiya ja sakta hai.

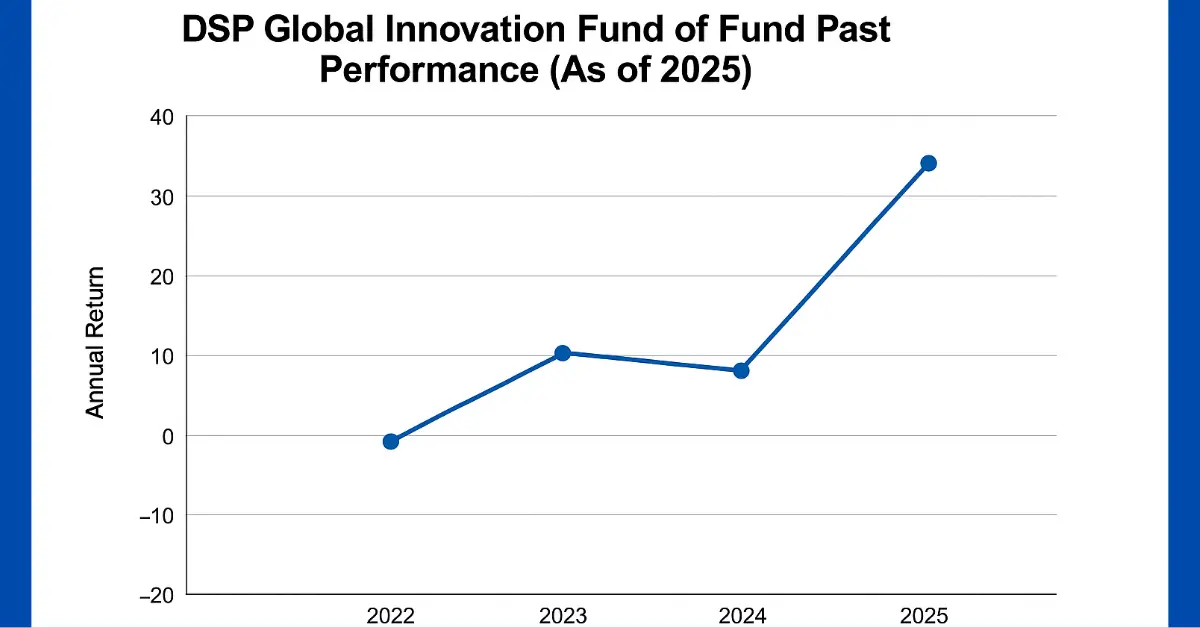

9. Past Performance (As of 2025)

- 1-Year Return: ~35%

- 3-Year CAGR: ~21% (since launch)

- Volatility: High

Note: Ye past returns future ke guarantee nahi hote.

Fund Comparison: DSP Global Innovation Fund of Fund vs Other Global Innovation Funds

Global innovation theme me invest karne wale kuch aur popular funds bhi market me hain. Niche table me DSP fund ka comparison diya gaya hai Axis aur Edelweiss ke similar funds ke saath.

| Fund Name | Type | Global Exposure | Risk Level | Return (1Y) | Min. SIP | Best For |

|---|---|---|---|---|---|---|

| DSP Global Innovation Fund of Fund | Fund of Fund | High (Multiple Countries) | High | ~35% | ₹500 | Long-term, Future Tech Exposure |

| Axis Global Innovation Fund of Fund | Fund of Fund | Moderate (Mostly US & Europe) | Moderate–High | ~22% | ₹100 | Moderate-risk Investors |

| Edelweiss US Technology Equity Fund | Direct Equity Fund | Low (US Tech Only) | High | ~30% | ₹500 | US Tech-focused Investors |

Note: Data as of July 2025. Returns are indicative and not guaranteed. Always review latest factsheets before investing.

10. FAQs

- Kya ye fund tax-free hai?

Nahi, equity-oriented nahi hone ke wajah se LTCG tax 20% indexation ke sath lagta hai. - Kitna minimum invest kar sakte hain?

₹500 SIP se shuruaat kar sakte hain. - Exit load kitna hai?

1% if redeemed within 1 year.

11. Conclusion – Kya Ye Fund Aapke Liye Sahi Hai?

Agar aap ek long-term investor hain, global innovation me invest karna chahte hain, aur thoda risk le sakte hain – to DSP Global Innovation Fund of Fund aapke portfolio ke liye ek valuable addition ho sakta hai.

Diversification aur futuristic themes me exposure ke liye ye ek achha gateway hai – lekin hamesha apne investment goal ke hisab se hi decision lein.

✅ Agar aap future-ready portfolio banana chahte hain, toh is fund par ek nazar zaroor daaliye.